how do i pay my personal property tax in richmond va

Payment Options Based on the type of payment s you want to make you can choose to pay by these options. To file a claim contact the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website.

Henrico County Announces Plans On Personal Property Tax Relief

Ad Register and Subscribe Now to work on NY Tips for Estimated Tax more fillable forms.

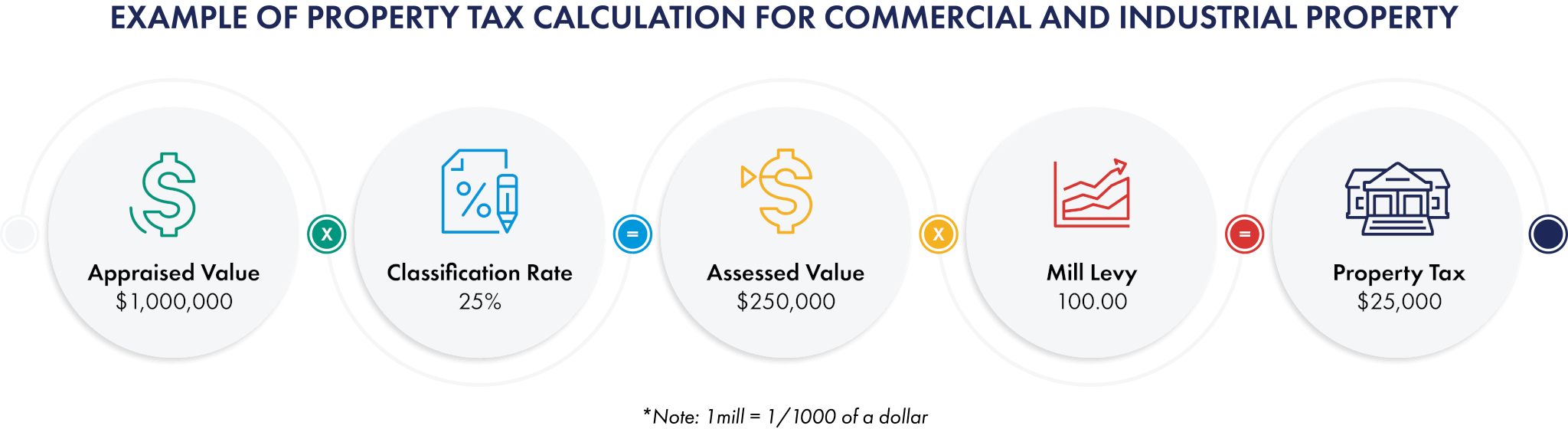

. Log in to QuickPay using your Virginia Tax account number and any 5-digit bill number. Virginia Department of Taxation For. The assessed value is multiplied by the appropriate tax rate.

For additional information visit Department of Finance website or call 804 501-4263. Reduce property taxes 4 residential retail businesses - profitable side business hustle. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly.

You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website. Richmond City collects on average 105 of a propertys. Department Ticket Number Social Security Number or.

Personal property tax bills have been mailed are available online and currently are due June 5 2022. Portsmouth levies a personal property tax on vehicles boats aircraft and mobile homes. Voucher 2-4 payments are processed by the Richmond County Treasurer.

How is the personal property tax calculated. Please contact us at 540 853-2521 or personalpropertyroanokevagov for Personal. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions.

Boats trailers and airplanes are not prorated. Does Your Vehicle Qualify for Personal Property Tax Relief. Try it for Free Now.

Ad Reduce property taxes for yourself or residential commercial businesses for commissions. All payments should be made payable to the Richmond County Treasurer. Taxpayers can either pay.

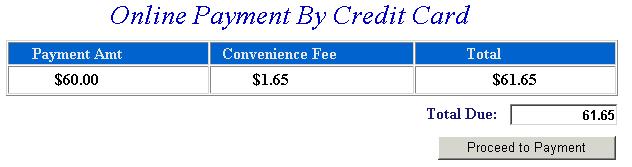

You can pay your personal property tax online with an electronic check by using our Easy Check program which offers two convenient options. Directly from your bank account direct debit ACH credit initiated from your. Upload Modify or Create Forms.

If you can answer YES to any. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. Can I Pay Va Property Taxes Online.

How do I pay my personal property tax in Richmond VA. 194 for 2022 x 31500 6111 Reduce the tax by the relief amount. 31500-6111 25389 Tax amount 25389 The following.

Personal Property Tax Rates Vehicles Autos trucks motorcycles and utility trailers are. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. On the Pay Personal Property Taxes Online Screen press the button containing your preferred method for finding tax information.

Personal Property Tax The Commissioner of the Revenues office is open for walk-in service. Calculate personal property relief. All property is taxable based on.

Use e-Signature Secure Your Files. Pay online directly from your bank account free Pay from your checking or savings account. Uncover Available Property Tax Data By Searching Any Address.

Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

Property Tax Calculator Estimator For Real Estate And Homes

Understanding Your Property Tax Bill Clackamas County

Taxes Mr Williamsburg Revolutionary Ideas On Real Estate Hampton Roads Virginia

Kansas Property Tax Kansas Department Of Commerce

Real Property Tax Howard County

Richmond Independent City Virginia Genealogy Familysearch

Property Taxes How Much Are They In Different States Across The Us

Taxes Mr Williamsburg Revolutionary Ideas On Real Estate Hampton Roads Virginia

How Much Virginia Personal Property Tax Bill We Pay For Multiple Cars Youtube